From spreadsheet to map in three simple steps

-

1. Copy your data

From spreadsheets, to tables in web pages, databases—anywhere you can visualize a table with location data you can map multiple locations with BatchGeo. If you are starting from scratch, we recommend using our Spreadsheet Template to get started with your data, then simply copy the data over to BatchGeo to create a pin map.

-

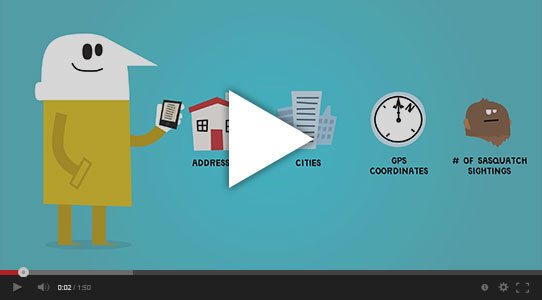

2. Set options

We make our best guess at your intended columns like the address, city, state, zip code, or latitude / longitude. You may want to set the options yourself if you don't like the default behavior.

-

3. Map Addresses

We plot your postcodes / addresses and make your multi pin map. It may take a few minutes depending on how many addresses you have, if you already had latitude and longitude in your data it will map instantly. After you are done mapping the addresses you can save to a web page using the "Continue & Save" option.

93,466

Active Users

17,947,186

Google Maps Created

1,282,595

Live Maps

Used by

Get more with Pro

Street View Integration

Heat Map Layer

No Ads

Multi Point Routing

10 Users Included

Advanced Features

Enhanced Security

Advanced Data Selection

More Data & Groups